free cash flow yield calculator

The gift is payable in cash worth Rs500000. The cash flows to MBS are paid monthly.

Fcf Yield Unlevered Vs Levered Formula And Calculator

If youre analyzing a company that doesnt list capital expenditures and operating cash flow there are similar equations that determine the same information such as.

. Then subtract capital expenditure which is money required to sustain business operations from its value. The Financials sector FCF rose from 757 billion in. You can also combine other metrics such as dividend yield to further shortlist the stocks.

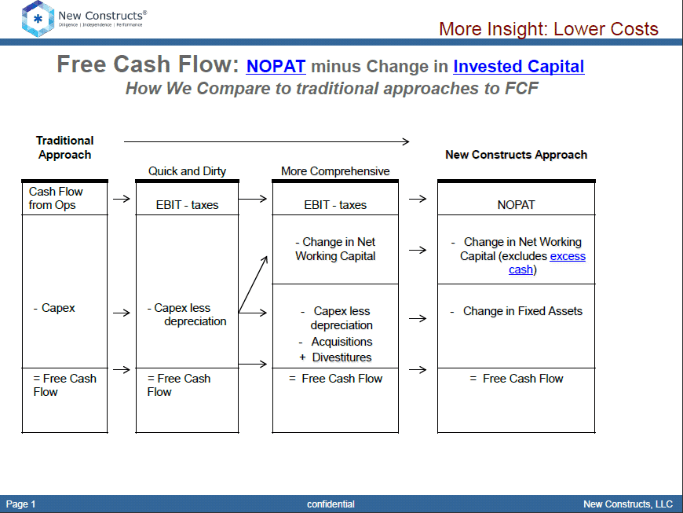

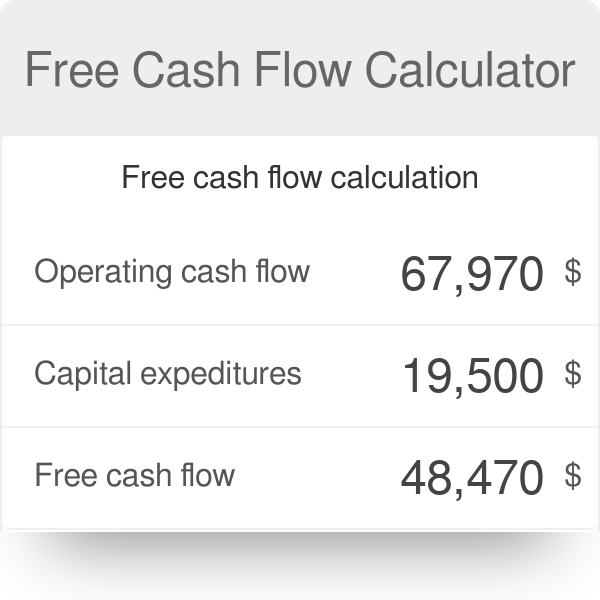

Bond equivalent yield calculation is a two-step process. The simplest way to calculate free cash flow is to subtract a businesss capital expenditures from its operating cash flow. What Is Free Cash Flow Yield.

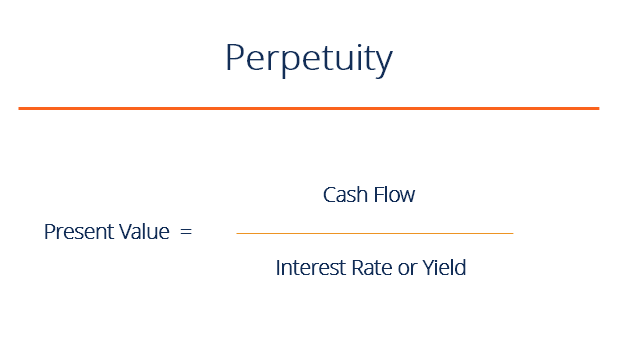

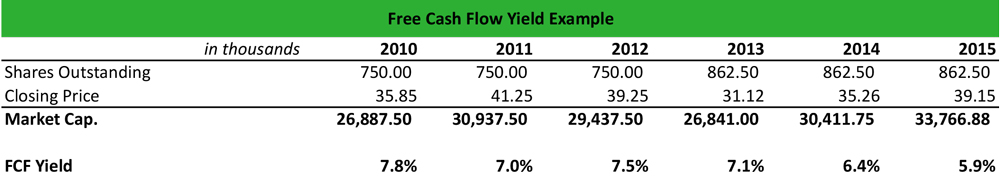

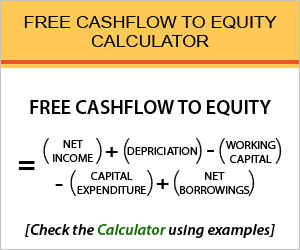

So the cash flow yield we calculate will also be monthly yield. Ad Calculate the impact of dividend growth and reinvestment. The formula for Terminal value using Free Cash Flow to Equity is FCFF 2022 x 1growth Keg The growth rate is the perpetuity growth of Free Cash Flow to Equity.

To break it down free cash flow yield is determined first by using a companys cash flow statement. But it will be paid in two installments. Sales at t0 multiplied with margins etc.

To make sure you have a thorough understanding of each type please read CFIs Cash Flow Comparision Guide The Ultimate Cash Flow Guide EBITDA CF FCF FCFE FCFF This is the ultimate Cash Flow Guide to understand the. Free cash flow sales revenue - operating costs. Instead of market capitalization it uses the price you paid for an investment as the denominator.

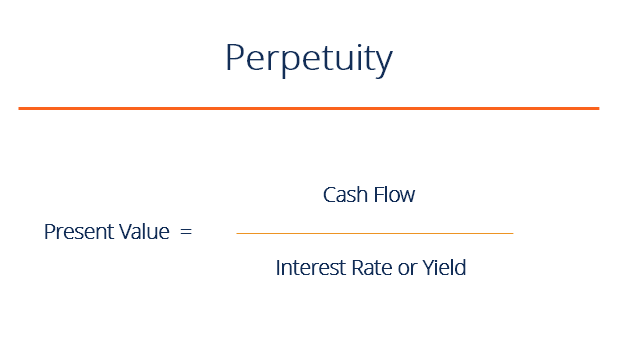

For example if you paid 100000 for a. Free cash flow per share 81 USD and. FCFY Free cash flow to firm FCFF Enterprise Value.

Free Cash Flow Yield 786. For example you can use high free cash. At t4 normalized cash flow at t0 and normalized yield.

Free Cash Flow Operating Cash Flow Capital Expenditure Net Working Capital. To calculate FCF get the value of operational cash flows from your companys financial statement. See the formula below.

It is mechanically similar to thinking about the dividend or earnings yield of a stock. The calculation of free cash flow yield is fairly simple. Hence Free cash flow available to the firm for the calendar year is.

Number of shares outstanding. The tool will also compute yield to maturity but see the YTM calculator for a better explanation plus the yield to maturity formula. Free Cash Flow from Operations 37914.

Once you calculate the Terminal Value find the present value of the Terminal Value. Free cash flow yield is a financial solvency ratio that compares the free cash flow per share a company is expected to earn against its market value per share. The formula for calculating YTM is shown below.

Furthermore we can calculate the free cash flow yield but we will need. Enter the bonds trading price face or par value time to maturity and coupon or stated interest rate to compute a current yield. Free cash flow FCF is more valuable than the net profit PAT of a company.

Free Cash Flow 550 million 100 million 175 million. Then use the resulting free cash flow as your basis for a yield and share potential calculation. October 22 2015.

This is generally considered a healthy number and is an improvement on an earlier. Cash Flow Yield on a Bond-Equivalent Basis. If all debt-related items were removed from our model then the unlevered and levered FCF yields would both come out to 115.

A higher free cash flow yield is better because then the company is generating more cash and has more money to pay out dividends pay down debt and re-invest into. Free cash flow. Then our free cash flow yield calculator results.

To understand it we will use a hypothetical example and calculate the free cash flow for an individual. In order to calculate YTM we need the bonds current price the face or par value of the bond the coupon value and the number of years to maturity. Free Cash Flow Yield measures the amount of cash flow that an investor will be entitled to.

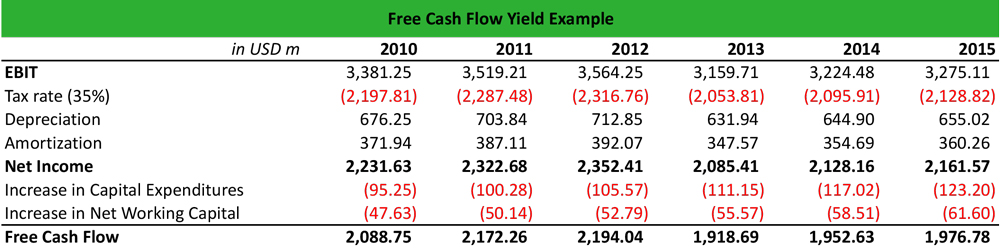

Free cash flow yield is really just the companys free cash flow divided by its market value. With a 59 FCF Yield investors are getting more FCF for their investment dollar in the Basic Materials sector. 5 Replies to Calculate the sustainable free cash flow yield to get an intuitive valuation feel Daniel Richter says.

The most common way to calculate free cash flow yield is to use market capitalization as the divisor. People sometimes describe this as free cash flow yield Cash on Cash Yield is a different measurement often used to evaluate real estate investments. Ad Our Business Experts Provide An In-Depth Analysis To Uncover Business Opportunity.

There are many ways to do it. Free Cash Flow 275 million. The levered FCF yield comes out to 51 which is roughly 41 less than the unlevered FCF yield of 92 due to the debt obligations of the company.

Cash Flow Statement A cash flow Statement contains information on how much cash a. An analysis of Apple AAPL on May 20 2015 for example gives the total operating cash flow as 7631 billion and the total market cap -- its total value based on the shares outstanding -- as 74938 billion with a resultant free cash flow yield of 763174038 or 1018 percent. Figure 1 shows trailing FCF yield for the Financials sector rose from 12 as of 33121 to 40 as of 31122.

Our Business Consultants Will Partner With You To Build Financial and Operational Success. Stock price 145 USD. Formula 2 FCFF Free cash flow yield calculation from a firms perspective equity holders preferred shareholders and debt holders is as follows.

Just like for semi-annual bonds here also we need to convert the cash flow yield to bond-equivalent yield. We have assumed this growth rate to be 3 in our model. The formula is as follows.

Cash flows rose faster than stock prices as the indexs free cash flow FCF yield rose to its highest level since 123118. Now to calculate the free cash flow yield we divide the free cash flow by the market cap of the company. Thats the ratio of free cash flow to market cap.

Lets say the monthly yield is 1. Hopefully this free YouTube video has helped shed some light on the various types of cash flow how to calculate them and what they mean. 2021 was a very profitable year for the SP 500.

This figure is also referred to as operating cash. We will see how. Suppose you won a prize in a car rally.

Market capitalization is widely available making it easy to determine. Eight NC 2000 sectors saw an increase in trailing FCF yield from 33121 to 31122. Where FCFF FCFF FCFF Free cash flow to firm or unleveled cash flow is the cash remaining after depreciation taxes and other.

One is to take all the SP500 stocks calculate their Free Cash Flow Yield and either pick the top 10-20 stocks or take stocks having a yield above certain percentage suhas 10 yield. How to Compute Free Cash Flow. We could also look at the free cash flow yield in relation to its trailing-twelve-month numbers or TTM to get the latest yield.

On this page is a bond yield calculator to calculate the current yield of a bond. The stock price considered is from January 2020 when the annual report was released. Yield to maturity YTM is similar to current yield but YTM accounts for the present value of a bonds future coupon payments.

Free Cash Flow Yield Formula Top Example Fcfy Calculation

Perpetuity Definition Formula Examples And Guide To Perpetuities

What Is Free Cash Flow Yield Definition Meaning Example

Free Cash Flow Yield Formula Top Example Fcfy Calculation

Free Cash Flow Yield Explained

What Is Free Cash Flow Yield Definition Meaning Example

Free Cash Flow To Equity Fcfe Levered Fcf Formula And Excel Calculator

Free Cash Flow And Fcf Yield New Constructs

/dotdash_Final_Free_Cash_Flow_Yield_The_Best_Fundamental_Indicator_Feb_2020-01-45223e39226643f08fa0a3417aa49bb8.jpg)

Free Cash Flow Yield The Best Fundamental Indicator

S P 500 Sectors Free Cash Flow Yield Rises Above Pre Pandemic Levels

Unlevered Free Cash Flow Definition Examples Formula

Fcf Yield Unlevered Vs Levered Formula And Calculator

Free Cash Flow Calculator Free Cash Flow

Free Cash Flow And Fcf Yield New Constructs

Free Cashflow To Equity Calculator Formula Check Example More

Free Cash Flow Yield Formula Top Example Fcfy Calculation

Fcf Yield Unlevered Vs Levered Formula And Calculator

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_Yield_The_Best_Fundamental_Indicator_Feb_2020-01-45223e39226643f08fa0a3417aa49bb8.jpg)

/dotdash_Final_Free_Cash_Flow_Yield_The_Best_Fundamental_Indicator_Feb_2020-01-45223e39226643f08fa0a3417aa49bb8.jpg)